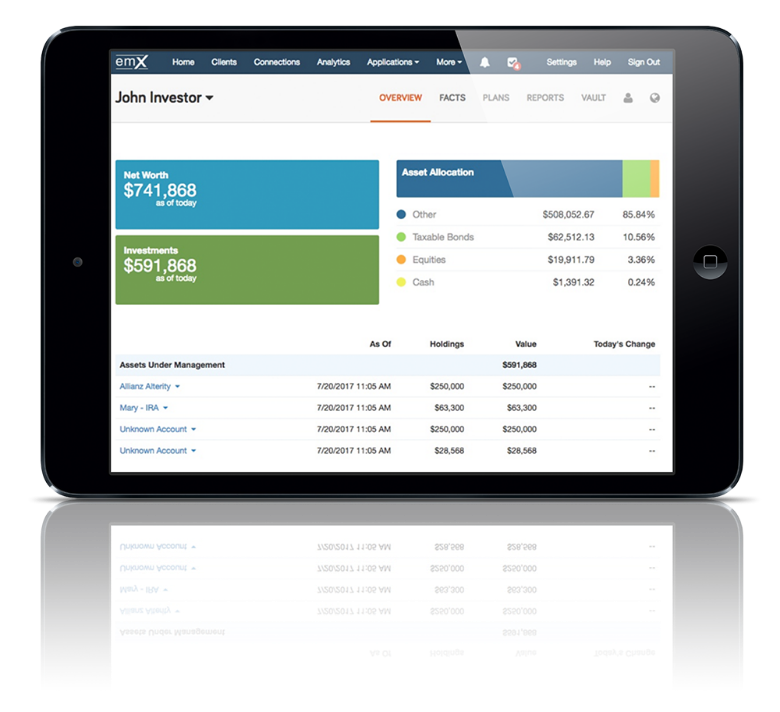

Envision a Clear Financial Path

Do you have confidence in your financial strategy?

Every individual has a variety of financial concerns unique to their situation. As your life changes, your investment, savings, and protection needs will shift. A well-designed financial plan may mean the difference between achieving your objective or falling short. Our process utilizes your priorities, hopes and dreams to craft a custom plan tailored specifically for you.